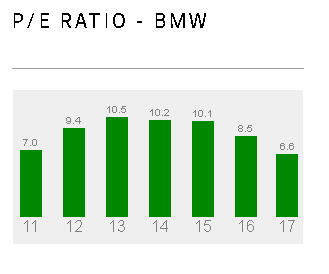

BMW 2021 - Financial Analysis: With a PE Ratio of under 5, why is this car company so cheap? - YouTube

BMW 2021 - Financial Analysis: With a PE Ratio of under 5, why is this car company so cheap? - YouTube

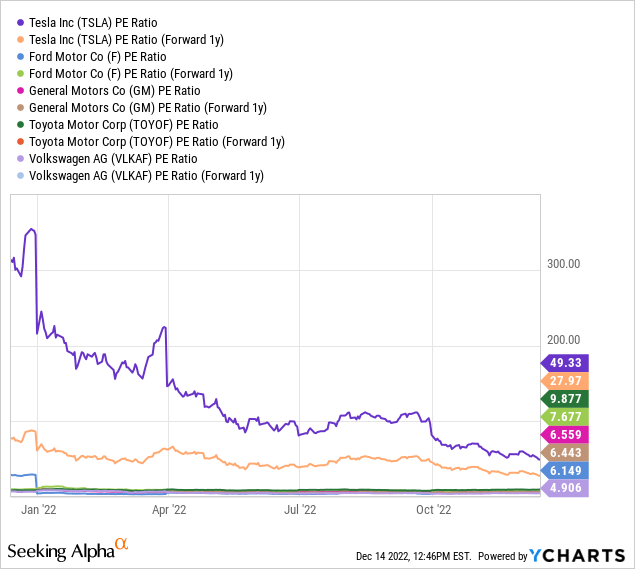

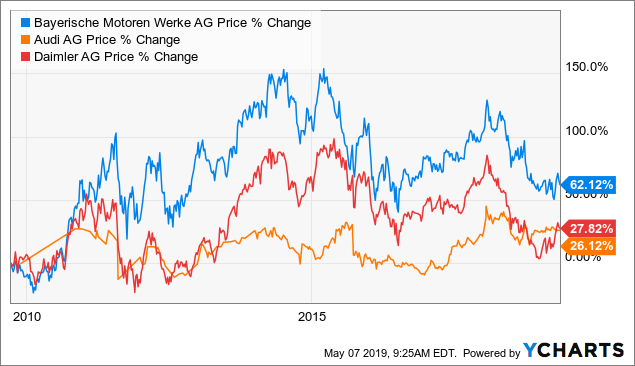

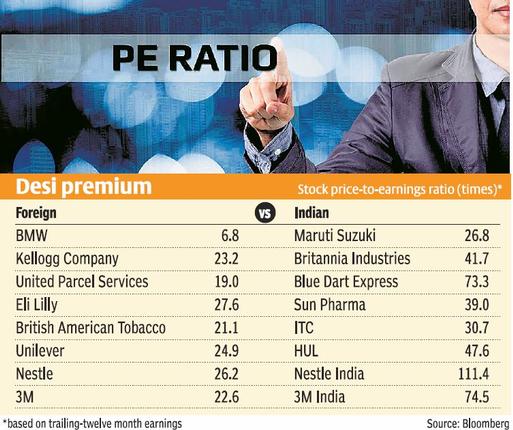

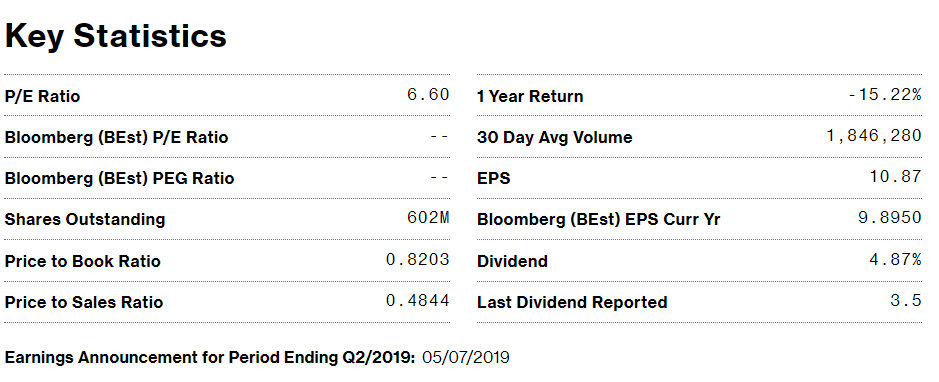

How Does Bayerische Motoren Werke's (ETR:BMW) P/E Compare To Its Industry, After The Share Price Drop?

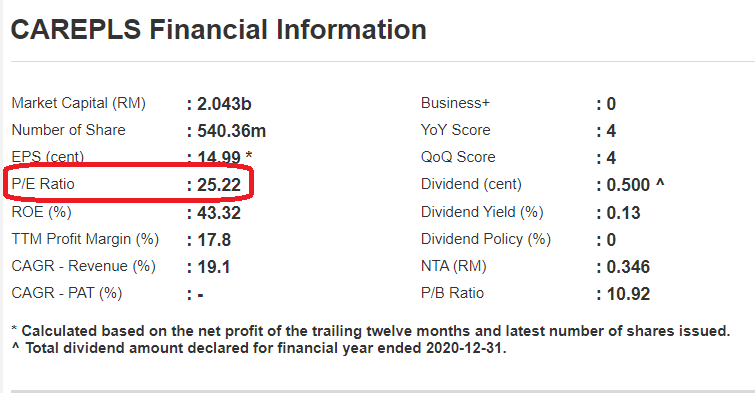

BMW 2021 - Financial Analysis: With a PE Ratio of under 5, why is this car company so cheap? - YouTube